Trading derivatives: sprinters, speeders and turbos

About tradingderivatives.eu

This site is intended for ambitious traders willing to accept large risks using leverage investment products. Tradingderivatives.eu does not apply fundamental analysis, but technical analysis instead. In short, tradingderivatives.eu follows and detects market trends. The reasons for these trends are given by the economic situations in the world's regions, but the timing of our trades are given by technical analysis only. We believe that fundamental analysis can not explain all fluctuations in the stock markets. We detect the slowest trends and follow them. We make money in both bearish and bullish markets. We show exactly what we do so you can copy us. However, we are not a bank. TradingDerivatives.eu is not accountable for your losses and profits. You remain in charge of your investments. We have a policy of full transparancy for our current positions but also on our track record.

Our tweets

We tweet on a regular basis about our portfolio suggestions. Also, we select the tweets of the trading community based on keywords and we retweet the most relevant ones. Hence our tweets are limited what we think is most useful to you. Tweets by @TrdngDrivatives

What are speeders, sprinters and turbos?

The differences between sprinters, speeders and turbos are marginal. Sprinters are supported by ING, speeders by the German Commerzbank and turbos by the Royal Bank

of Scotland (RBS). Basically, all three are financial derivatives that enable you to borrow money for the acquiring of securities. Investing with borrowed money

enables you to make much higher profits. Downside is that your losses can also be huge. Because your investments are increased with the leverage factor high profits

can be achieved. Leverage works both ways so your losses can also be considerable. Therefore, these leverage products are intended for experienced investors willing

to take high risks.

The relation with exchange traded funds (ETF)

Do speeders, sprinters and turbos compare to exchange traded funds? Yes and no. An exchange traded fund (ETF) is often a combination of stocks in the same ratios as a

stock index. ETFs like these track a stock index. Since a stock index contains many stocks in itself, your stock portfolio is well spread over many branches of

industries - while you have the advantage of few kinds of effects in your portfolio. This gives you easy risk management. Another advantage of ETFs is that is value

is coupled to the index in a fixed ratio. As a result, companies behind ETFs have to buy and sell their ETFs constantly. Every few seconds they change their bid and

sell prices with massive volumes behind it. This means that the market is made for you. You always have an opportunity to buy or sell the ETF of your choice. This

also holds for sprinters, speeders and turbos; companies behind these leverage products also 'make the market'. If you invest in a leverage product in an index, your

portfolio is just as well-balanced as if you would buy an ETF in that index.

Downsideof exchange traded funds are that stock indices are rather stable. Price

fluctuations are low. This is where leverage products like index ETFs are different from index tracking leverage products. In short, by choosing the leverage you

balance your risk and your profit - all while maintaining a well balanced portfolio. Using sprinters on an index it is easier to make large profits (or losses) than

by using an ETF.

When you invest $1000 in sprinters in the DAX, you have to chose a leverage factor for your sprinter. Not all possible leverage factors

are available. Suppose you select a sprinter with a leverage factor of 6.4. In this case ING will invest $5400 on top of your $1000; in total $6400 is invested.

Assuming that the DAX goes up 10%, the $6400 becomes $7040. You sell your sprinters and your $5400 loan is repaid to ING. The return on your investment of $1000 is

$7040 minus $5400 = $1640. If you had bought a DAX tracker you would have made $100, so the sprinter multiplied your profit with 6.4, the leverage factor. Speeders

and turbos are almost equivalent to sprinters. Main difference is the supporting bank.

The formulas

Sprinters are maintained by ING, a large Dutch bank. ING benefits from the sprinters they offer in several ways. You pay interest on your loan. Therefore, your

investment is only successful if the underlying security was more profitable than your loan. Any invested dollar, borrowed or yours, should bring you profit and this

is achieved only if, in this case, the DAX index goes up so fast that it compensates the interest on the sprinter. Other ways ING profits from sprinters because of

the difference between the sell and buy prices, the spread. This is the price difference at a given moment between the ask and bid prices of a sprinter. ING, RBS and

other suppliers of leverage products like sprinters sometimes increase the spread to reduce their risks and maximise their profits.

Of course, the vision

on the investment can be wrong. In that case, your $1000 investment has to be enough to compensate the loss on the loan part of your sprinter. When your investment is

no longer sufficient, i.e. when ING starts to loose on the money they lent you, they end the sprinter. Your investment is gone and the sprinter can not be bought nor

sold any more. Even if this happens outside of opening hours of the relevant stock exchange market, you can not loose more than your investment. ING is accountable

for any losses beyond your own investment. Such a situation can occur when the DAX index opens so low that not only your own investment is gone, but also part of

ING's. In that case ING will not ask additional money from you, although the sprinter price would be negative in this case.

Now in the jargon of the

financial world, the finance level fl of a sprinter is the amount of money you borrow from the bank expressed per sprinter. If the underlying security pays dividends

the finance level of the sprinter is dropped by the corresponding amount. The relation between the price ps of the sprinter, the finance level fl and the

price pu is as follows: .

The leverage factor

is given by

Sometimes you will find other formulas describing the relation between the leverage factor, the price of the sprinter,

speeder or turbo and the price of the underlying security. These account for the differences in currencies, for instance between the US dollar and the European Euro.

Also, deviating formulas take into account that some prices of underlying securities are very high; as a result, some investors would not be able to buy a single

sprinter, speeder or turbo of this high-priced security. Therefore, ING offers you sprinters corresponding to 10% or even 1% of the underlying value. This makes the

sprinters more affordable and therefore easier to trade. Similar arrangements are made for turbos and speeders.

ING cancels sprinters when their leverage

factor becomes one, i.e. the finance level fl becomes

zero. When there is nothing to finance anymore, ING does not receive interest any more and their profit is gone. The sprinter seizes to exist and it is removed from

your portfolio without compensation.

Sprinters, speeders and turbos can also be used to make profits on bearish markets. In this case the price of the

sprinter goes up when the price of the underlying securities go down. This is called 'short selling' as opposed to the traditional 'long selling' explained above. The

price of a sprinter short is given by .

The interest you pay on sprinters long is taken into account by the exponential increase of the finance level fl . Even if the price of the underlying securities

would remain constant over extended periods of time, the price of the sprinter long decreases. This comes down to you paying interest. When you are short selling, you

receive interest. The difference between the long and short interest rates is usually 4%. The interest you pay is 2% above LIBOR on sprinters long; on sprinters

short, you receive 2% less than LIBOR.

Dividends are accounted for by changing the finance level fl of a sprinter. For long sprinters, the finance level

is decreased with the dividend while it is increased for short sprinters. You will receive dividend on the securities that were bought for you with the borrowed money

as well as your own, so dividends are also leveraged by sprinters.

What makes TradingDerivatives.eu different from others?

In short: full disclosure. Plenty of graphs show you our trades and how much you would have made if you had done the same. All kinds of analysts give advice, but it

is hard to track their results. TradingDerivatives.eu gives full disclosure. Note that the graphs also show that some trades went wrong, something other analysts and

their websites try to hide.

TradingDerivatives.eu does not promote buying speeders, sprinters or turbos in individual stocks. This site differs from

others on this point. We think the risk is too high. Many good, solid securities of respected companies lost a significant fraction of their value over night: Enron,

Ahold, World Online, Lehman Brothers and so on. Given that most investors do not spread their investments enough, there is the risk of significant losses due a crash

of a single company. Investing in indexes circumvents that problem; an index is already a combination of many stocks. That reduces the risk and gives a spread

automatically. On top of that, the risk you want to take can be tuned by the leverage factor. High risk, high leverage and vice versa - and you keep a good overview

of your investments.

However, even when your money is invested in a range of sprinters, speeders or turbos of seemingly independent economies, an event on

the global scale can cause a freefall in all indexes. That is the risk of investing on stock markets. Therefore, you should not invest money you can not afford to

loose, even if the profits are expected to be huge. For instance, 10-15 years before your retirement you should consider lower risks. You can still follow the

recommendations on this site, but with much reduced leverage factors.

Stock market simulation

The results presented here are based on simulations of historic data using dedicated software developed by TradingDerivatives.eu. The software contains several

parameters. Our software has analysed all possible values of these parameters. The results with the highest profits are presented on this website. It is assumed that

the selected settings will give good results in the future - much like they suggested for the past. In short, the software 'detects the trend'; after all, the trend

is your friend.

The simulations are based on historic data on the indexes. Some information was not taken into account, like dividends. Also, the interest

rate was kept fixed. The simulation assumes an interest rate of 6% on long positions and 2% on short positions. At the moment the interest rates are lower so your

profits will be higher than indicated on TradingDerivatives.eu.

Business model and disclaimer

TradingDerivatives.eu offers you information on our transactions based on our simulations and daily developments on the exchange markets. It is up to you to follow

us. You follow us at your own risk. In the future, adds and donations may support us. TradingDerivatives.eu will not become a bank and we will not charge you if you

want to follow us. You do not have to register for information on TradingDerivatives.eu. We disclose our positions for free, for always. Look here

for more disclaimer details.

How to copy the leverage strategies of TradingDerivatives.eu?

You will have to come back to TradingDerivatives.eu to check the funds of your interest on a daily basis. Follow our steps as quickly as possible, but build up your

portfolio in a period of several weeks. We think patience is important. Trading a long time after a suggested buy is risky, especially if you use the highest

leverage. Do not go all-in at once in that case, but invest in 10 or more equal parts of your money over a period of several months. Your first investments should not

be more than a few percent of your fortune. Just let your sprinters develop for half a year or more and see what happens; after half a dozen years this small fraction

of your fortune has become as large as the rest. When that happens, you are ready to reconsider your strategy.

In any case, do not exceed the recommended

leverage factors. Sooner or later all of your investment will evaporate. The leverage factors in combination with the rest of the model are checked to be safe. Higher

leverage factors are not.

All graphs on TradingDerivatives.eu are updated on a daily basis. The latest considered moves are indicated per index or per

fund. If you decide to follow our positions, you can buy a tracker as a relatively low risk investment. It is not recommended to buy options because our mathematical

models do not suggest an expiration date.

Table of latest transactions

Below you find the table of our last transactions.

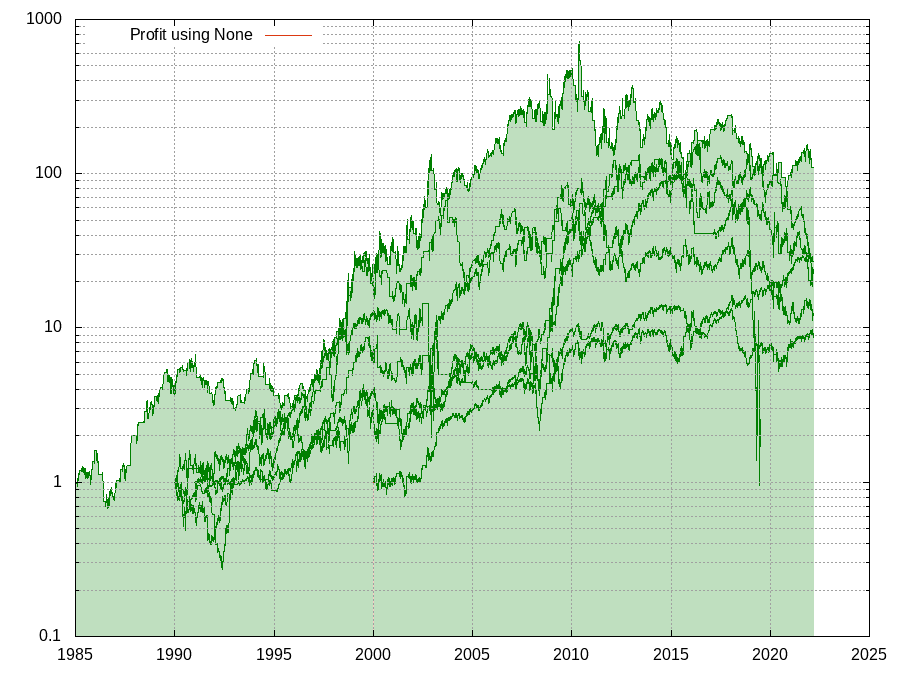

Return on investments in the long run

The graph below shows the results obtained by TradingDerivatives.eu on selected indexes. The buttons can be used to highlight the results on the index of your choice.

Disclaimer abstract: This site shows how we are investing. We do not accept any responsibility for your losses. Standard rules of stock

market trading apply: investments should be spread over multiple funds and brokers.

TradingDerivatives.eu uses cookies.